Trademark Infringement Alert: How to Fortify Your Brand’s Defenses

Safeguarding your brand is crucial in today’s dynamic business world. Your brand is more than just a name or logo, it’s a representation of your

Safeguarding your brand is crucial in today’s dynamic business world. Your brand is more than just a name or logo, it’s a representation of your

Congratulations on successfully registering your company in India! The journey to becoming a legitimate business entity is a significant milestone. However, the work doesn’t stop

What is an Income Tax Notice? An income tax notice is an official communication issued by the tax authorities, typically the income tax department, to

Amazon, the largest online retail platform globally, has become synonymous with e-commerce. As a Fortune 500 organization, it offers a vast array of consumable and

The catering industry in India is thriving, with an increasing number of people opting for catering services for various events and occasions. However, with the

We all want to know how to save money on taxes or, more accurately, plan our investments. Tax planning is necessary, but so are ways

In a significant legal development, the High Court has recently granted relief to Zydus Glucon-D, a leading pharmaceutical company, by barring Cipla from using the

The Companies Act 2013 provides a comprehensive framework for determining directors’ remuneration in Indian companies. The Act outlines specific director remuneration determination, approval, and disclosure

Income Tax Returns (ITR) are crucial to financial obligations for individuals or businesses. It involves reporting income, claiming deductions, and fulfilling tax liabilities. Considering the

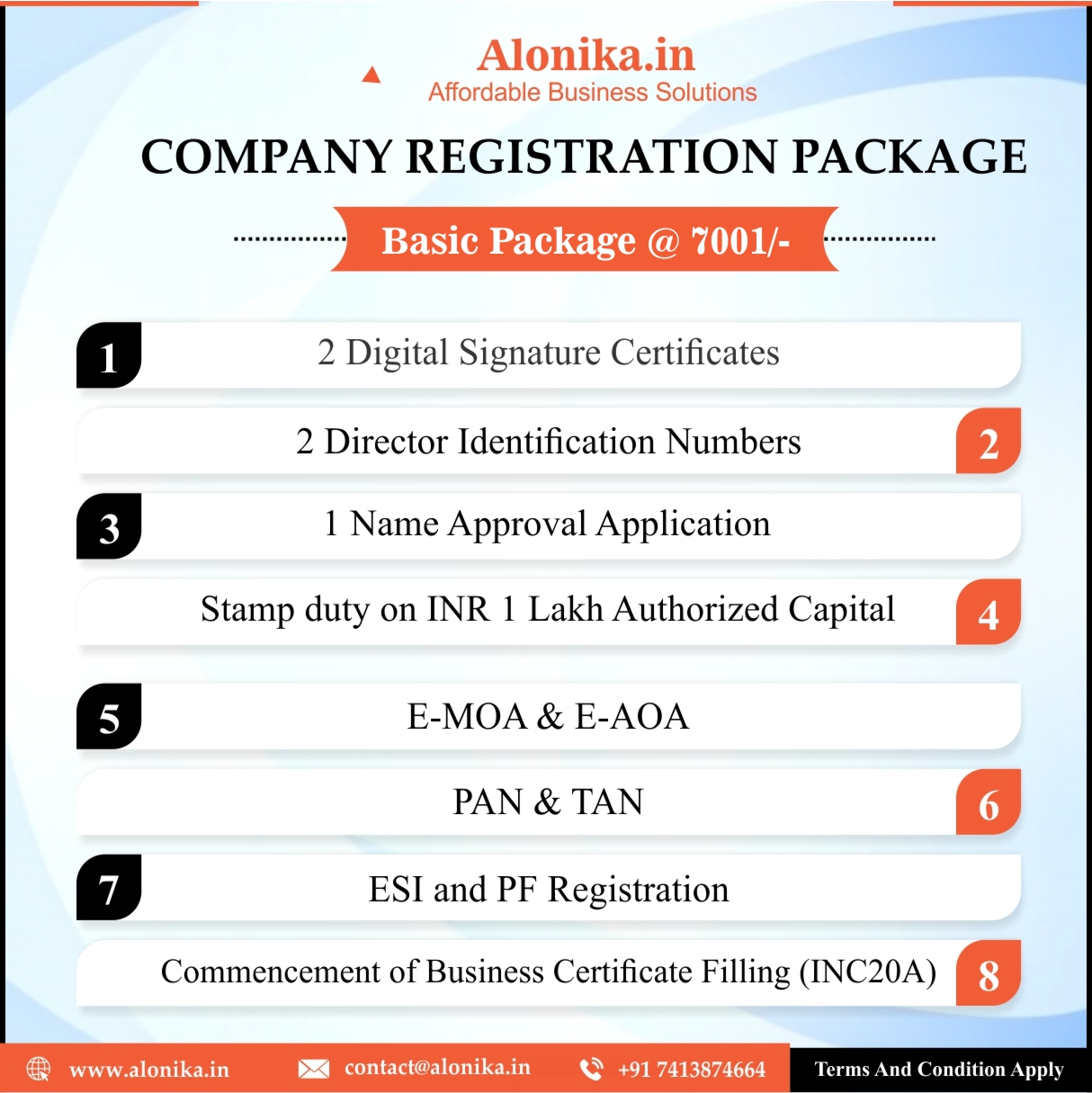

The establishment gains legitimacy and credibility after registering as a corporation. It is gaining popularity and widespread acceptability in the cutthroat global market. While adhering to business registration in Kolkata, one can benefit from various legal advantages. It is a lawful means of promoting relevant goods and services without taking any chances as one grows their firm. Once the corporation is registered under the corporate act, running its business projects and carrying out its corporate strategies would be pretty simple and comfortable. Here, we can help you with all kinds of company registration services in Kolkata, such as starting a new firm, registering an LLP or LLC, registering a Pvt ltd company name, and learning about other IPR concepts. We arrive with our client’s legal business needs in hand, presenting the finest choice to function in today’s demanding environment. To provide the corporate sector with valuable services, we regularly work while updating our legal executives with the most recent revisions.

From the law’s viewpoint, a private limited company is distinct from its owners. PLC’s owners are shareholders (stakeholders), and directors run the business on their behalf. PLCs may have a share, guarantee, or unrestricted liability limitation.

A public limited company is a business restricted by shares and allowed to issue shares to the general public to raise the initial capital. According to the Indian Companies Act 1956, the minimum number of shareholders is seven, the maximum number of shareholders is unlimited, and the minimum paid-up capital is around five lakhs. After successfully forming and incorporating the norms and regulations outlined in the Indian Companies Act, public limited companies may apply for registration.

According to Section 262 of the 2013 Companies Act, formally registering a one-person corporation in India is acceptable. A single director and a single member representing the complete form must register a one-person corporation in India. This sort of corporation has a very low compliance burden compared to a private business. Issue shares to the general pub.

A limited liability partnership (LLP) combines the advantages of a partnership and a limited liability company. It began to take shape in India after January 2009 and became an instant hit with new businesses and professional services. The purpose of the LLP was to offer a straightforward corporate structure that would benefit owners by limiting their responsibility.

The main factors influence people’s decision to use an LLP as their company model:

One must fulfill the following requirements to be qualified for LLP company registration in India:

When referring to the non-profit goals and purposes of various institutions and organizations, we frequently refer to them collectively as NGOs, Trusts, or Societies. These types of organizations are dealt with by a company registered under Section 8 of the 2013 Companies Act. A company reported to promote commerce, the arts, science, sports, education, research, social welfare, religion, charity, environmental protection, or any other object is solely used to further these objectives.

The Companies Act of 2013 governs Nidhi Companies, businesses in the non-banking financial sector. This business is relatively simple to set up as a corporation and encourages lending and borrowing among its members. To qualify as a Nidhi Company, it must have at least 200 members annually. They use their members to conduct business.

For Directors and Shareholders

For registered Office address

Approval of Name: Deciding on the company name that will submit to MCA for approval is the first step in incorporating a business. Idealized names submitted for approval ought to be distinct and connected to the company’s business operations. MCA

Application of DSC & DPIN: The next step for startup registration is to apply for a digital signature and DPIN. A digital signature is an online signature used for signing the e-forms, and DPIN refers to the Director’s identification number issued by the Registrar.

Submission of MOA and AOA: Once the name is authorized, the Memorandum of Association and Articles of Association, which include the company’s rules and laws governing how the organization runs, must be created. The MCA receives both the MOA and the AOA and the subscription statement for authentication and approval.

Create forms and paperwork: Please complete the application forms thoroughly, attach the required documentation, and have it professionally reviewed before submitting it to the ROC and paying the fee.

Get a certificate of incorporation: The registrar issues the incorporation certificate after completing all the required paperwork and filing with the department. Essential details about the firm, including the CIN number, name, and date of incorporation, are listed in the certificate of incorporation.

Open a bank account: You can send a copy of your MOA, AOA, and PAN together with the bank’s account opening form after receiving your incorporation certificate to create a bank account.

Alonika is the leading CA, CS, and Lawyer firm in Kolkata. We have a qualified and experienced team of CA who will solve all your problems. So, if you want to start your company in Kolkata then choose us.